Poles are eager to settle with BLIK for online products and services. Consumer trends in 2022

Marta Nowak, business development specialist at Polish Payment Standard, the operator of BLIK

Over the past decade, Poles have certainly increased their confidence in online shopping. According to a recent report published by the Chamber of Electronic Economy, the percentage of Internet users shopping online has almost doubled, rising from 45 per cent to an astounding 87 per cent. The e-commerce market in Poland, despite the macroeconomic turbulence, continues to grow, and customers are increasingly satisfied with the opportunities offered to them in the online sphere. The last decade has also seen an increased interest in cashless payment methods - such as BLIK. We use it not only to settle purchases on popular sales platforms but also to settle our accounts and to donate to and support charities. BLIK's transaction data accurately reflects the observed change in consumer shopping behaviour.

Undisputed leader in e-commerce

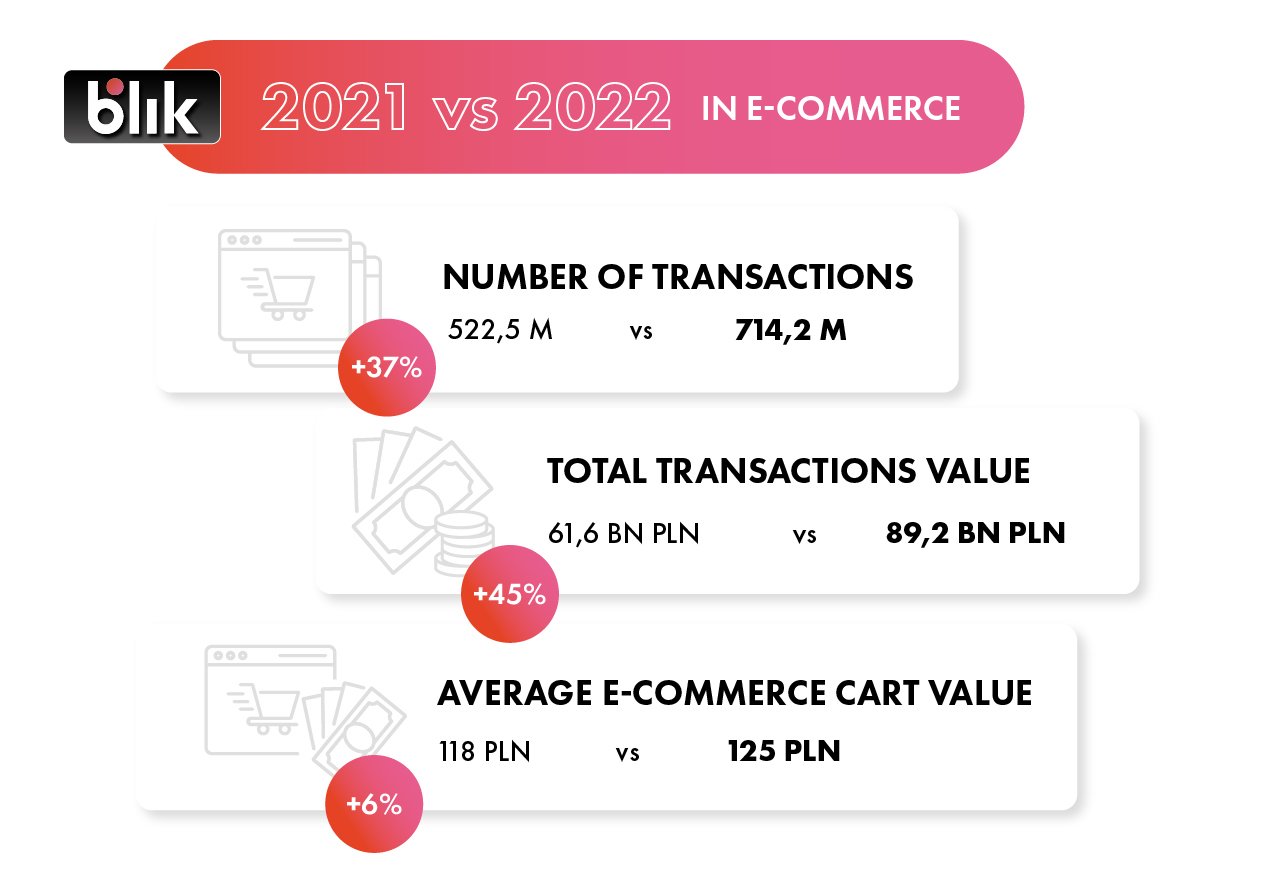

As expected of all transactions made with BLIK, nearly 60 per cent are those in e-commerce. Last year, customers paid for their online purchases 714.2 million times – over a third more than in 2021. At that time, there were 522.5 million online transactions. Between January and December 2022, the value of online transactions reached PLN 89.2 billion (EUR 18.5 bn) compared to PLN 61.6 billion (EUR 13,1 bn) a year earlier, and the average value of a single online purchase was PLN 129 (EUR 27,55).

The fact that BLIK is the most popular online payment method is also confirmed by cyclical data from the National Bank of Poland. Since the fourth quarter of 2018, Poles have been paying with BLIK far more often than with debit cards when shopping online. According to the most recent data available from the National Bank of Poland, at the end of September 2022, the number of operations carried out using BLIK was higher than the number of card transactions by as much as 228 percent. It is worth mentioning, that when BLIK started to dissociate itself from debit cards, this difference was only 5 percent.

This is not surprising. BLIK, as a universal payment system, is now available throughout the entirety of Polish e-commerce. Thus, based on an analysis of transactions carried out online in individual shop categories, it is possible to indicate which products and services were more willingly purchased in a given period and which fell in demand. Looking at the results for the whole of 2022, certain trends in consumer behaviour and decisions can be observed.

Firstly – increased interest in second-hand platforms

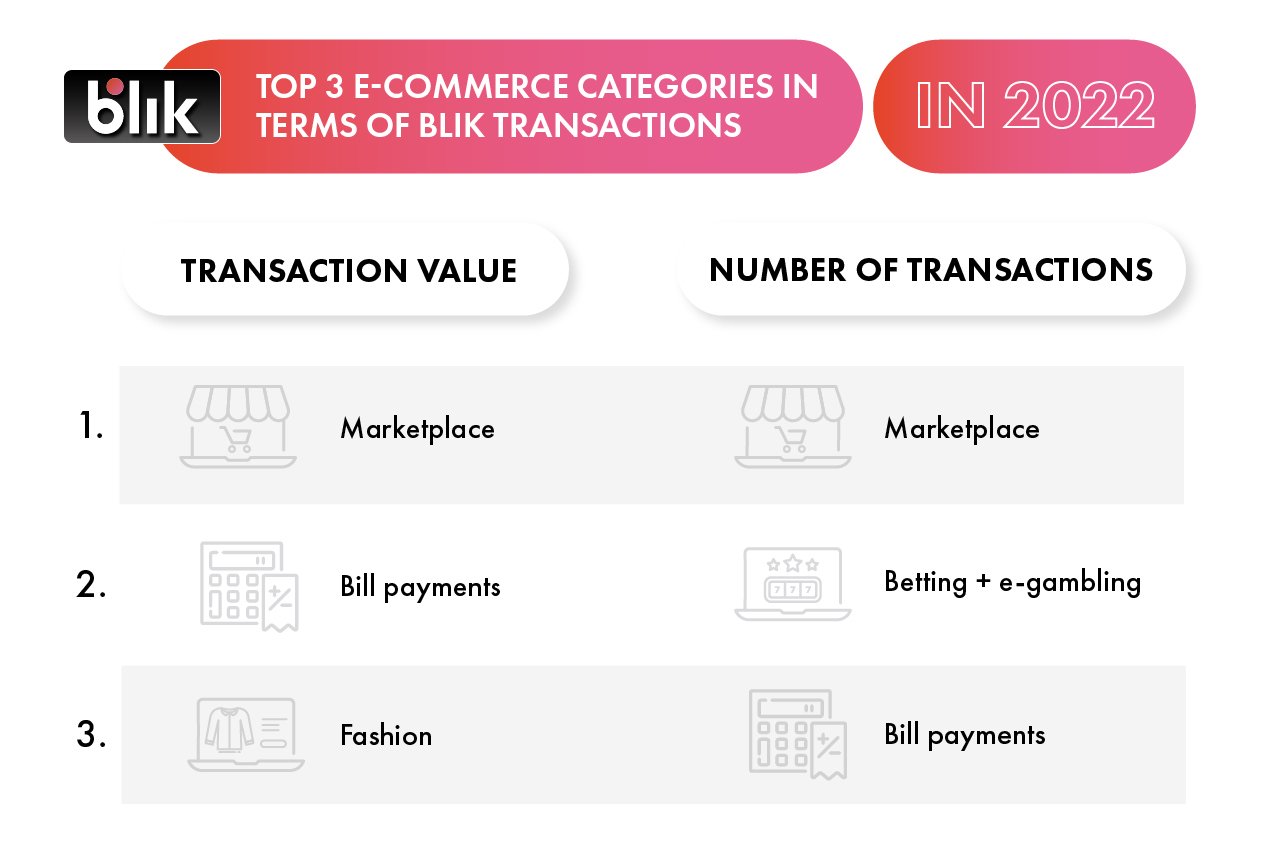

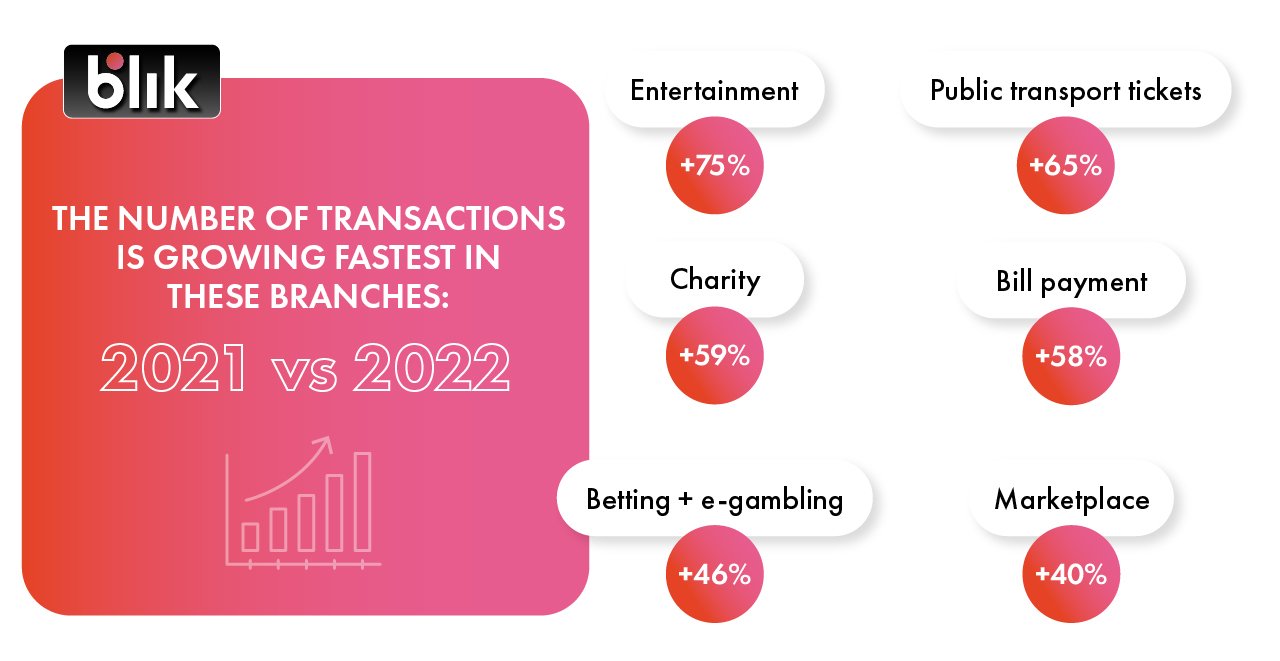

BLIK's transaction data suggests, that marketplace platforms – both B2B, B2C and C2C – are the largest category in e-commerce. They are currently responsible for around 30 percent of BLIK operations online, and when comparing transaction results year-on-year, it's an increase of nearly 40 percent. Therefore, it is unsurprising that this market is attracting domestic and foreign new entrants. Nevertheless, the withdrawal of one of the most popular marketplace platforms from Poland shows that this is a very demanding type of business, and only the strongest players will remain on the market.

It is noteworthy that the fastest growing marketplace category is C2C - that is, platforms where you can buy second-hand items. We are observing a new trend here – conscious consumers who continue to buy online in times of crisis, but the place of purchase is changing. These services are characterized by being twice smaller average shopping basket than B2C marketplace platforms.

Secondly – betting shops with more transactions than fashion

The category, that generates a high number of BLIK transactions, is e-gambling and betting. Interestingly, it is second only to marketplace platforms in terms of the number of transactions, but has significantly more than fashion. Such a high volume of transactions indicates the growing importance of this industry, which recorded a result that was 46 percent better year-on-year. The situation changes when looking at the value of transactions and the average basket. Poles spent an average of PLN 212 (EUR 45) on clothing and footwear purchases last year, while it was around PLN 62 (EUR 13.2) on e-gambling and betting.

Thirdly – a post-pandemic boom in the transport and entertainment industry

The abolition of Covid restrictions has positively impacted two industries directly and significantly affected by the restrictions, namely transport and entertainment. In 2022, compared to 2021, the number of short- and long-distance ticket purchases increased by as much as 65 per cent. The highest number of transactions was recorded in October, which can be attributed to the return of students to the cities and increased demand for public transport and rail tickets. A similar upturn could also be observed in the entertainment industry, which recorded a 75 percent year-on-year increase in terms of the number of transactions. It is worth mentioning that this industry is, however, characterised by a high degree of volatility, which largely depends on the announcement of an artist's tour or festival ticket sales.

Fourthly – charities have moved into the online sphere

Poles are increasingly willing to help those in need and support online fundraisers. We could observe the highest transactional activity in online donations at the beginning and end of the year. BLIK's transaction data shows that December and January are the months when users are most keen to support charity campaigns - they have quite a selection of fundraisers at this time. The average donation to a selected fundraiser last year was close to PLN 54 (EUR 11.5). February and March this year saw a 59 percent increase in donations to foundations or platforms aggregating fundraisers compared to the same period in 2021, which can be attributed to an increased desire to help Ukraine.

Lastly – we settle current liabilities online

Bill payments, including gas and phone top-ups, are a category that has seen continued growth from quarter to quarter. In 2022, 58 percent more such transactions were recorded than in the previous year. Users using BLIK on the internet can count on the fast completion of transactions. This convenient form of payment attracts not only tech-savvy users but also those less familiar with new payment solutions who are concerned about the security of their money. As a result, more and more users are choosing to pay their bills with BLIK, and in turn, more and more services are making this preferred payment method available to their customers.

The text refers to BLIK's transaction data completed by users between January and December 2022 at 673 online shops.

BLIK is a common standard for mobile payments. The possibility of using BLIK in mobile banking applications is now available to practically every customer of domestic payment institutions offering a mobile application. Polski Standard Płatności (PSP) is responsible for developing the system. PSP is constantly developing BLIK's capabilities, so that the system is as functional as possible for its users. The shareholders of the PSP company are: Alior Bank, Bank Millennium, Santander Bank Polska, ING Bank Śląski, mBank, PKO Bank Polski and Mastercard.